The State of Customer Engagement in APAC

Published on March 31, 2021/Last edited on March 31, 2021/5 min read

Mary Kearl

WriterThis year we're pleased to introduce our first ever Global Customer Engagement Review, a new report with tons of valuable learnings that brands can use to evaluate and elevate their own customer relationship-building efforts. Here you will find some of the most important highlights we discovered about the state of customer engagement specifically in APAC.

What to Know About the Study and the APAC Countries Represented

We commissioned Wakefield Research to conduct this first annual study on behalf of Braze. As part of the Review, Wakefield Research surveyed 1,300 marketing executives at the VP level and higher at the helm of brands with an annual revenue of at least $10 million. These leaders represent B2C companies from across the globe, including Australia, France, Germany, Indonesia, Japan, Malaysia, Singapore, Thailand, the UK, and the US.

Within the APAC region, 400 companies were represented, with 72% based in Japan, 9% based in Indonesia, 9% based in Thailand, 5% based in Malaysia, and 5% based in Singapore. The verticals represented include a range of businesses—Retail, Health and Wellness, Financial Services, QSR/On-Demand, and Media and Entertainment.

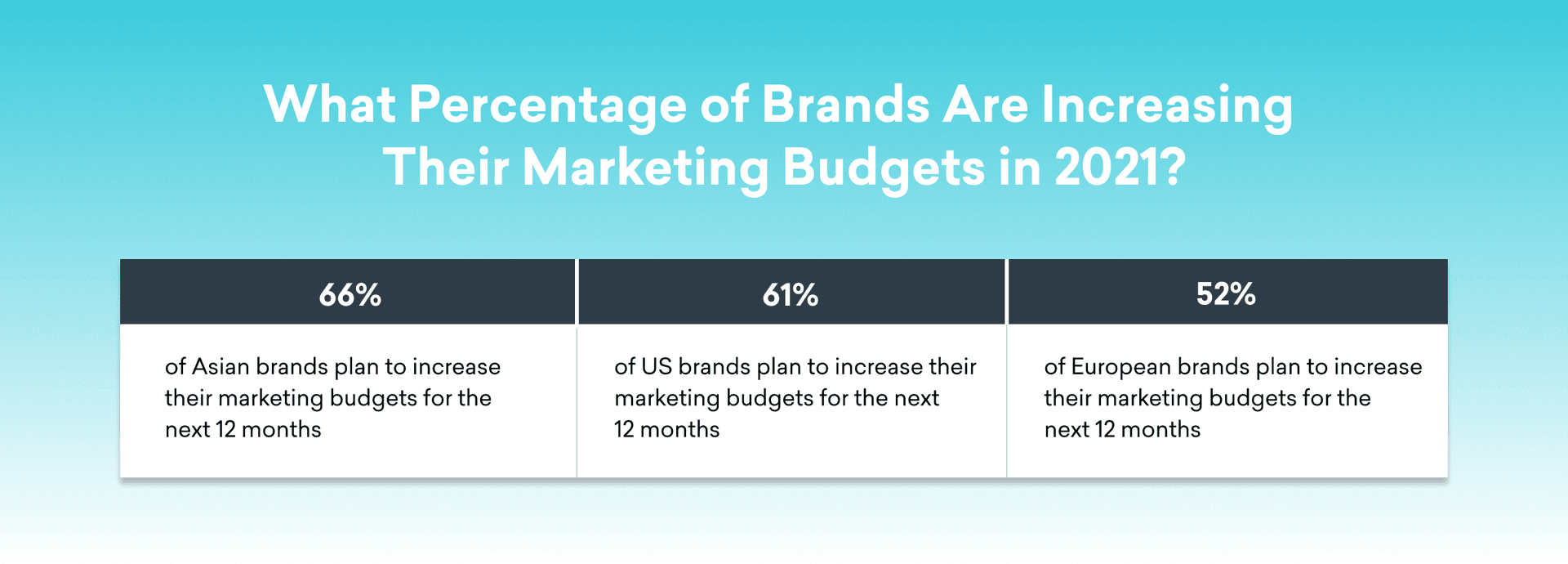

1. More Asian Brands Plan to Increase 2021 Marketing Budgets Than Companies Based in the US and Europe

While our research found that the majority of brands around the world plan to increase their marketing budgets for 2021, that trend was particularly pronounced in the APAC region. In fact, our survey found that a notably larger number of APAC brands were expected to boost budgets, especially compared to European brands.

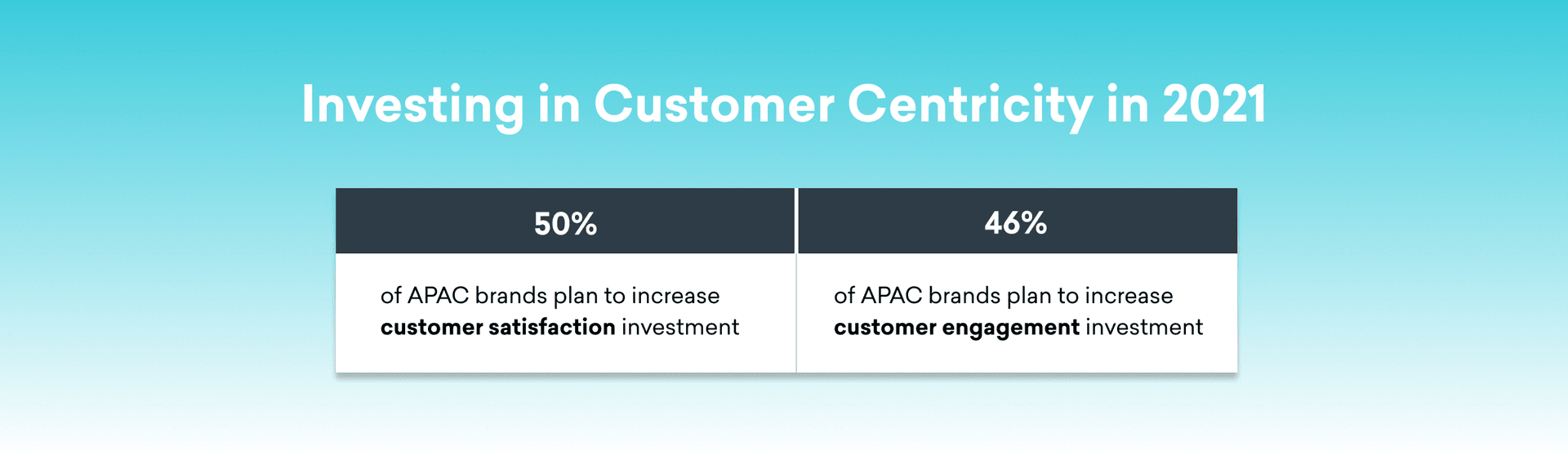

2. Customer Satisfaction Is a Top Investment Priority for Asian Brands

Compared to other regions in the globe, Asian brands report being least concerned that their customer engagement metrics aren’t translating into business outcomes.

- Asia: 68% said they are concerned

- Europe: 73% said they are concerned

- US: 78% said they are concerned

This could be due to the fact that brands in most of Asia are prioritizing investments that support improving the customer experience.

These spending patterns may also reflect heightened mobile penetration in the region, with brands realizing the opportunity that exists to build first-party mobile services and engagement outside of popular channels like WeChat and WhatsApp.

One outlier in the region is Japan. This country ranked investing in customer engagement much lower than other Asian countries, with only 32% of brands based in Japan saying they plan to increase investment over the next 12 months, the lowest across all of APAC and third lowest across all global regions.

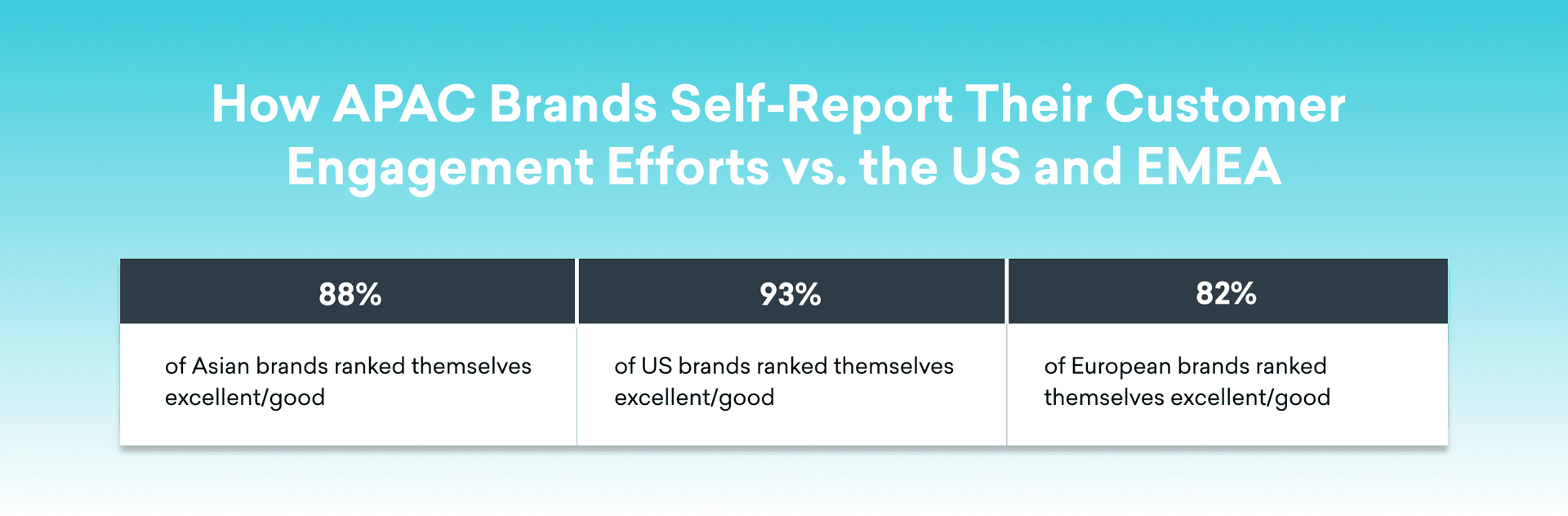

3. Most Brands Highly Rate Their Customer Engagement Efforts—and Exceeded 2020 Revenue Goals

When asked how successful their company is at customer engagement, 88% of Asian brands self-rated their efforts as "excellent" or "good." Of the Asian countries surveyed, Singapore came in highest at 94%, with Japanese brands the least confident at 87%. However, even the Japanese rate came in above the European average, speaking to the confidence level that brands in the region hold in connection with their customer engagement programs.

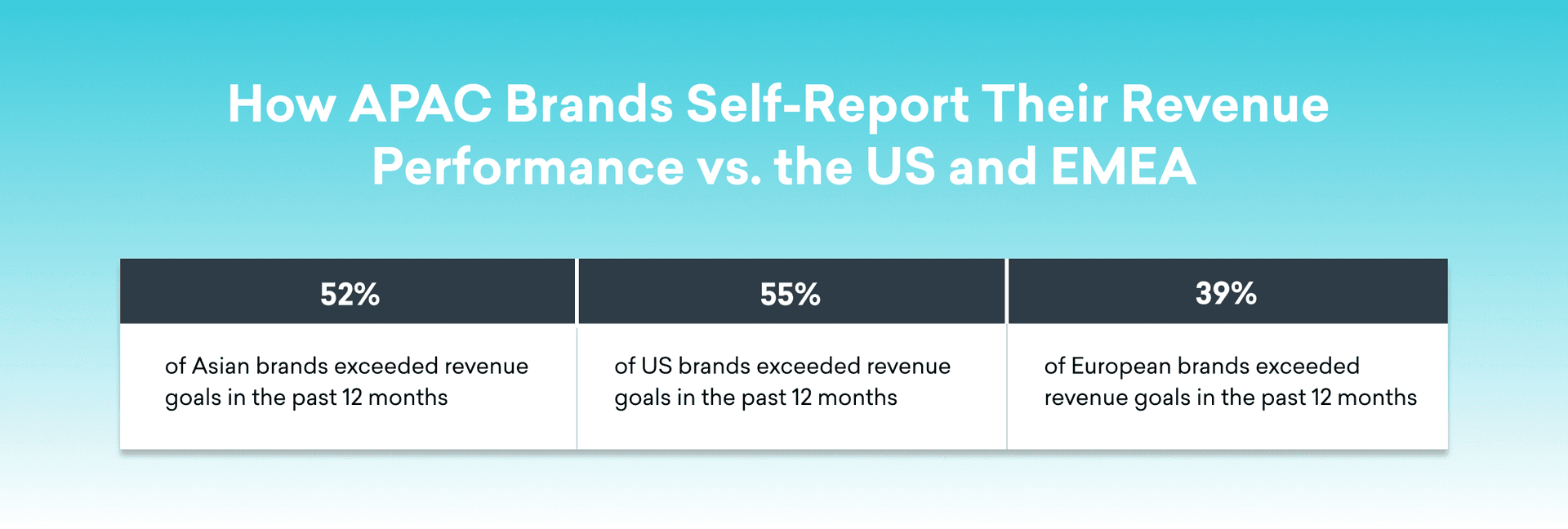

At the same time, more than half of APAC brands (52%) reported exceeding their revenue goals in 2020, compared to only 39% of European brands—who were also less likely to self-report strong customer engagement efforts.

Brands based in Singapore stand out with a particularly strong performance within the APAC region. A whopping 74% of leaders surveyed from Singapore said they exceeded their revenue goals. That's the highest out of all countries globally and more than double the results of companies based in countries like France (27%), Germany (32%), Indonesia (33%), and Australia (31%).

Given that exceptional performance, it's likely no coincidence that companies based in Singapore plan to increase their marketing budget by 80%—14 points higher than the average increase projected for APAC countries overall.

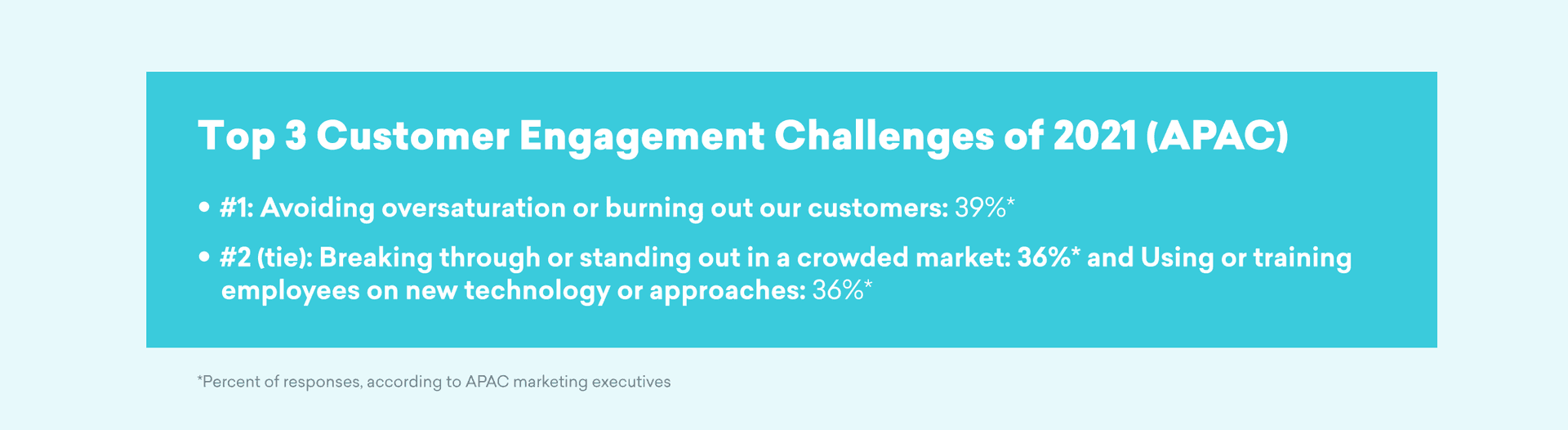

4. Asian Brands See Avoiding Marketing Saturation as Top Customer Engagement Challenge in 2021

While every brand has its own unique challenges and opportunities in today’s customer engagement landscape, we found some key trends in this area for APAC brands. Here's what APAC marketing executives said would be the big issues to tackle in the year ahead.

As engagement has become increasingly digital in response to the COVID-19 pandemic, brands have had to grapple with a crowded, noisy landscape for digital marketing. Our research found that leveraging multiple digital channels can help brands break through to users, but marketers should also be thoughtful about marketing pressure and send frequency to ensure a positive, cohesive brand experience for consumers.

5. Cross-Functional Teamwork and Personalization Key Needs for APAC brands

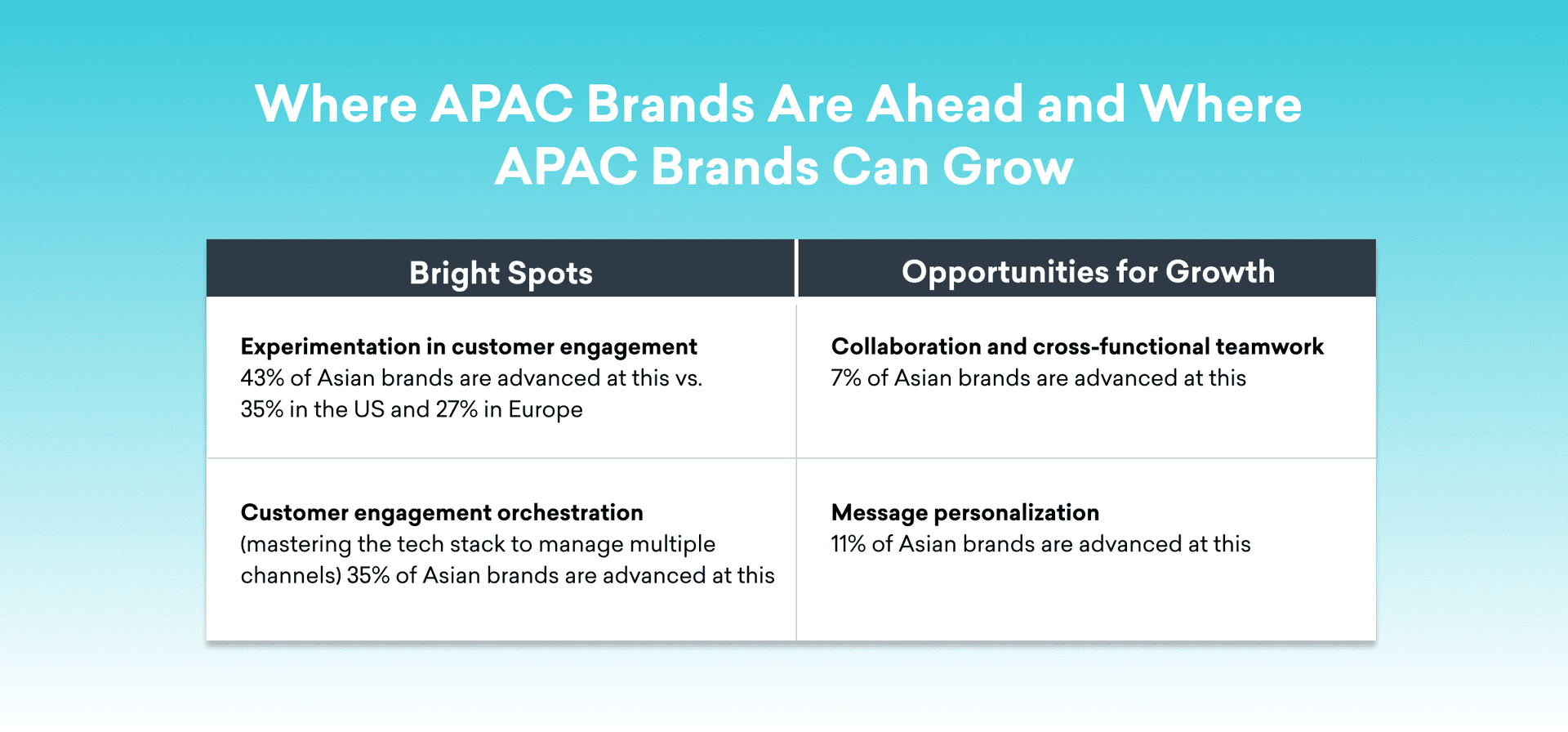

According to our survey, the top two areas where APAC brands are the most advanced when it comes to customer engagement are experimentation and orchestration—that is, effectively carrying out messaging campaigns and marketing activities and testing and optimizing those activities to improve results.

On the flip side, two of the areas where APAC brands most need to prioritize growth are adopting cross-functional teamwork and personalization strategies. While our research found that brands around the world are seeing similar struggles in these areas, the low results are notable given the general strong performance across most metrics by Asian brands.

Final Thoughts

To find out how the state of customer engagement in APAC compares to the rest of the world, download our full 2021 Global Customer Engagement Review for more insights about what brands across the globe accomplished in 2020 and what they're prioritizing over the next 12 months ahead.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

View the Blog

The new inbox reality: How iOS changes are reshaping email marketing

Aparna Prasad

Experience optimization: Turning data insights into better journeys

Team Braze

December 2025 Bonfire Marketer of the Month: Jagex’s Emma Oliver