The State of Customer Engagement for Financial Services Brands in 2023

Published on April 26, 2023/Last edited on April 26, 2023/6 min read

Team Braze

Each year, Braze conducts research to better understand the evolving customer engagement landscape and to help marketers prepare themselves for the challenges and opportunities ahead. Here are the major takeaways from the 2023 Global Customer Engagement Review when it comes to the current state of customer engagement for financial services brands and the top strategies brands in the space can use to drive activation, monetization, and retention.

It’s a Competitive Customer Engagement Environment for Financial Services Brands

To win over today’s customers, financial services brands need to stand out—and to meet rising consumer expectations around privacy, options, value, trust, and personalized experiences. And given the current moment’s economic volatility and the rise of new payment methods, brands in this space need to demonstrate value beyond transactions, and engage users through their financial journeys in ways that nurture their experience and win long-term loyalty.

Top Strategies for Improving Customer Engagement for Financial Services Brands in 2023

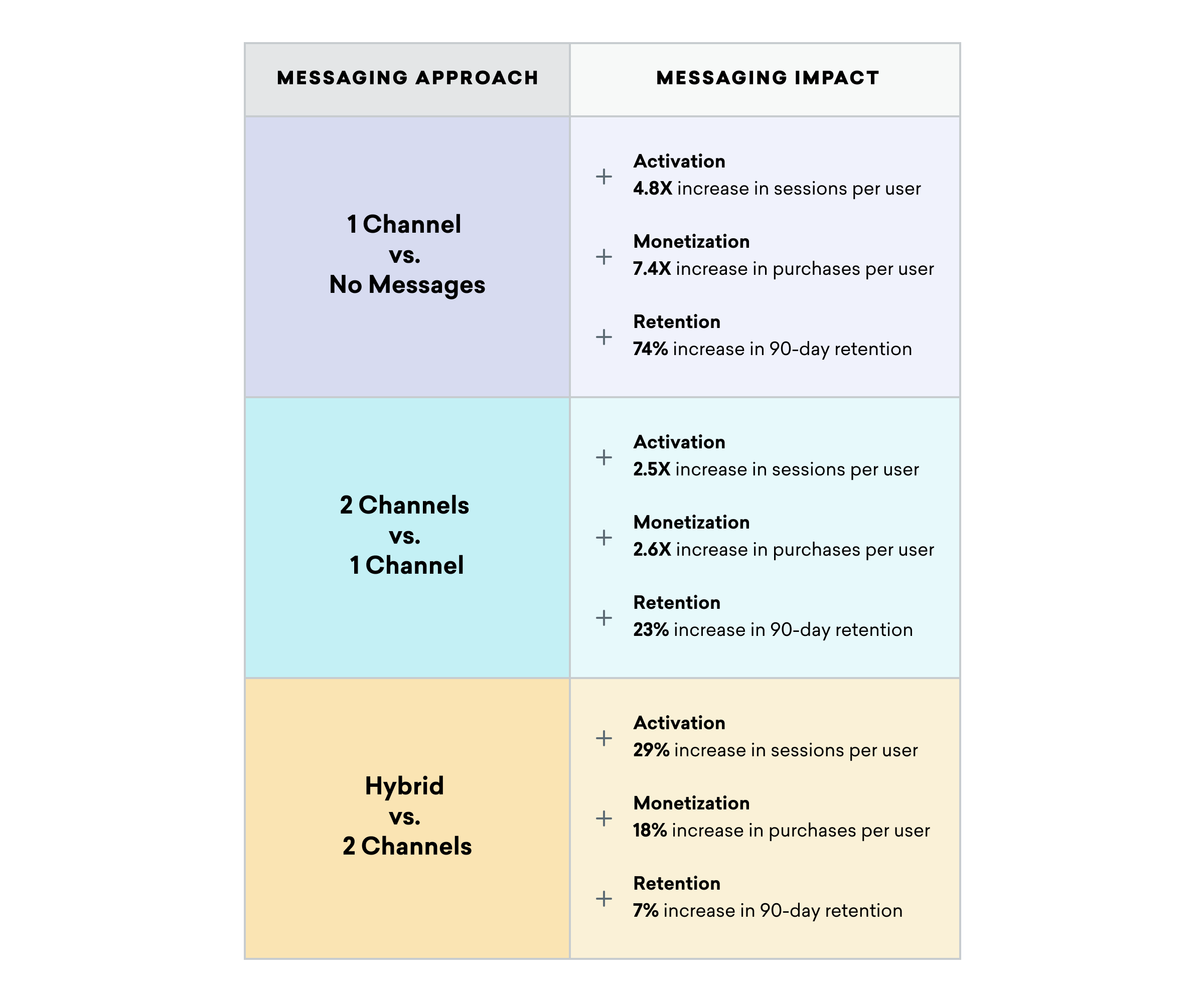

Using cross-channel customer engagement that’s focused on customers’ preferred messaging channels—particularly mobile channels—is an effective approach that can help organizations bolster outcomes across customer activation (sessions per user), monetization (purchases per user), and retention, according to our research.

#1: Leveraging cross-channel customer engagement

Keeping in touch with customers using popular channels like email marketing and web and mobile messaging is a powerful strategy for activating, monetizing, and retaining financial services customers.

Using one channel alone helps banking and financial brands boost sessions per user by nearly 5X, increase purchases per user by more than 7X, and raise 90-day retention by 74%, compared to users who received no messages.

Adding another channel to the mix and using both out-of-product (push, email, SMS, etc.) and in-product messages (in-app/in-browser messages and Content Cards) helps customer engagement professionals achieve even more gains.

#2: Utilizing the right combination of channels

According to the 2023 Global Customer Engagement Review, certain combinations of messaging channels can help financial services brands achieve maximum results.

- 4X retention: Using a combination of Content Cards, email, in-app messaging, and mobile push helps companies can increase six-month retention by 4X compared to sending no messages

- 1.9X retention: Messaging users via a combination of email, mobile push, in-app messaging, and Content Cards helps companies increase six-month retention by 1.9X compared to using only one messaging channel

#3: Incorporating mobile as part of a broader customer engagement strategy

Top-performing financial services brands (which we refer to as Ace brands) are 48% more likely to use mobile push than less mature organizations, according to our 2023 Customer Engagement Review analysis conducted using The Braze Customer Engagement Index.

This Index is a proprietary framework we developed in 2021 to assess brands against 12 key factors that drive customer engagement. Less mature brands that are just integrating customer engagement into their business strategy fall into the “Activate” category, mid-level “Accelerate” brands have more established customer engagement programs but that lack a comprehensive view of customers, and “Ace” brands include customer engagement leaders that have lifecycle-centric customer engagement programs that are owned by cross-functional teams, built on streaming data, and deliver stronger results—including a 168% uplift in sessions per user compared to non-Ace brands.

#4: Using real-time data to power segmentation, targeting, and analytics

Ace brands in the financial services industry are 63% more likely to use a real-time data stream to power segmentation, targeting, and analytics, compared to non-Ace brands in the space. By leveraging always-on data, marketers can power more relevant and responsive customer messaging, supporting deeper relationships and better business outcomes.

Key Priorities for Customer Engagement for Financial Services in 2023

These are the areas where financial services organizations plan to step up their customer engagement efforts this year.

#1: Sending more helpful messages for customers

According to our research, financial service companies indicated that not only do they plan to send more messages to customers to keep them engaged, they want to send outreach that includes helpful information and resources (e.g. bill reminders, offers of support). This is particularly relevant for customers who may be struggling financially and may be seeking out these resources.

#2: Adopting advanced data management best practices

Ace brands in the financial services industry rank the highest when it comes to data management—that is, when it comes to combining data from multiple sources, leveraging real-time segmentation, and managing messaging channels. However, they also rank data management, particularly the continuous management and collection of new data, as the greatest challenge for 2023, reminding us that even sophisticated marketers can find themselves facing obstacles as they become more mature in their customer engagement efforts.

Get the Complete State of Customer Engagement in 2023

Find out the top three worldwide trends in customer engagement this year, according to the Braze-commissioned Wakefield Research survey of 1,500 VP+ marketing decision-makers across 14 global markets. Get the details in the 2023 Global Customer Engagement Review.

Methodology

For the analysis included in the 2023 Customer Engagement Review, Braze pulled anonymized and aggregated behavioral data from 775+ Braze customers across our US, APAC, and EU clusters to analyze app activity, message engagement, and purchasing trends by industry. These statistics span January 1, 2022 to December 31, 2022 and include data from over 8.5 billion user profiles and 53 sub-industries. Of this data, over 110 Braze customers, over 330 million users and 4 sub-industries were deemed Financial Services Brands for purposes of the discussion included herein. The raw data has been cleaned using volume and company count checks so that no one brand or group of brands is over-represented. For all purchase- and messaging-related stats, only brands tracking the relevant information have been included so as not to skew the analysis. All uplift figures greater than 100% are rounded to the nearest decimal point, and all uplift figures below 100% are rounded to the nearest whole percent. When comparing two rounded numbers, percent change metrics are calculated as the difference between the two numbers after rounding.

The Braze Ace Technology, Teams, and Business Impact metrics for Financial Services Brands were measured by selecting the top 50th percentile of Braze customers compared to the full data set of Financial Services Brands based on average sessions per user, average user lifetime, and message engagement for the period of January 1, 2022 to December 31, 2022.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

View the Blog

How behavioral marketing turns data into personalized experiences

Team Braze

Enterprise generative AI: Transforming data, decisions, and customer experiences

Team Braze

Omnichannel personalization: Delivering consistent, connected customer experiences