Since its founding in 2020, Singapore-based Hugosave has been elevating lives through WealthcareⓇ, which is about equipping people with the right tools and knowledge while inculcating within them the habits for long-term savings and sensible investments. They aim to help people make sound financial habits second nature with their “Little, Often, Early” mantra, i.e. saving and investing a little at a time, doing it often and starting as early as possible. All this is in the hope of building financially healthy and thriving communities.

To differentiate themselves from competitors in their space, Hugosave has democratized financial tools. What was once out of reach to the person on the street is now accessible to everyone; every cent is saved and clients can start investing with as little as S$2. A painless journey to money mastery is the goal—not only can clients start their journey for next to nothing, they also get access to a wealth of knowledge about how to invest right when they sign up.

Realizing that a personalized customer engagement strategy was integral to their goals, Hugosave decided to start leveraging Braze at launch. Specifically, they needed a product that would be able to ingest their data effectively, absorb customer events, enable them to work seamlessly across platforms, and provide personalized sequences on a cohort basis, among other capabilities. The best option? Braze.

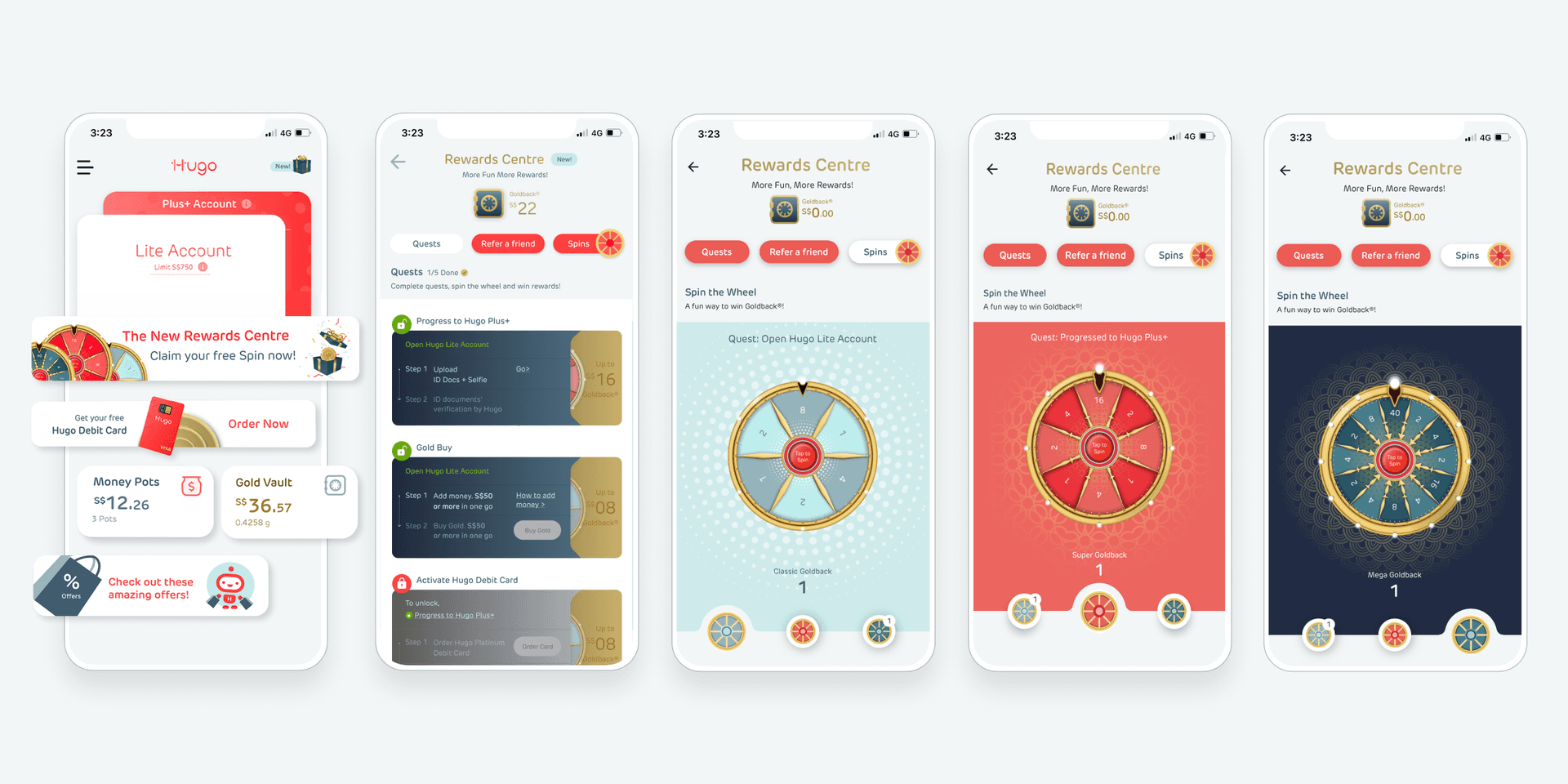

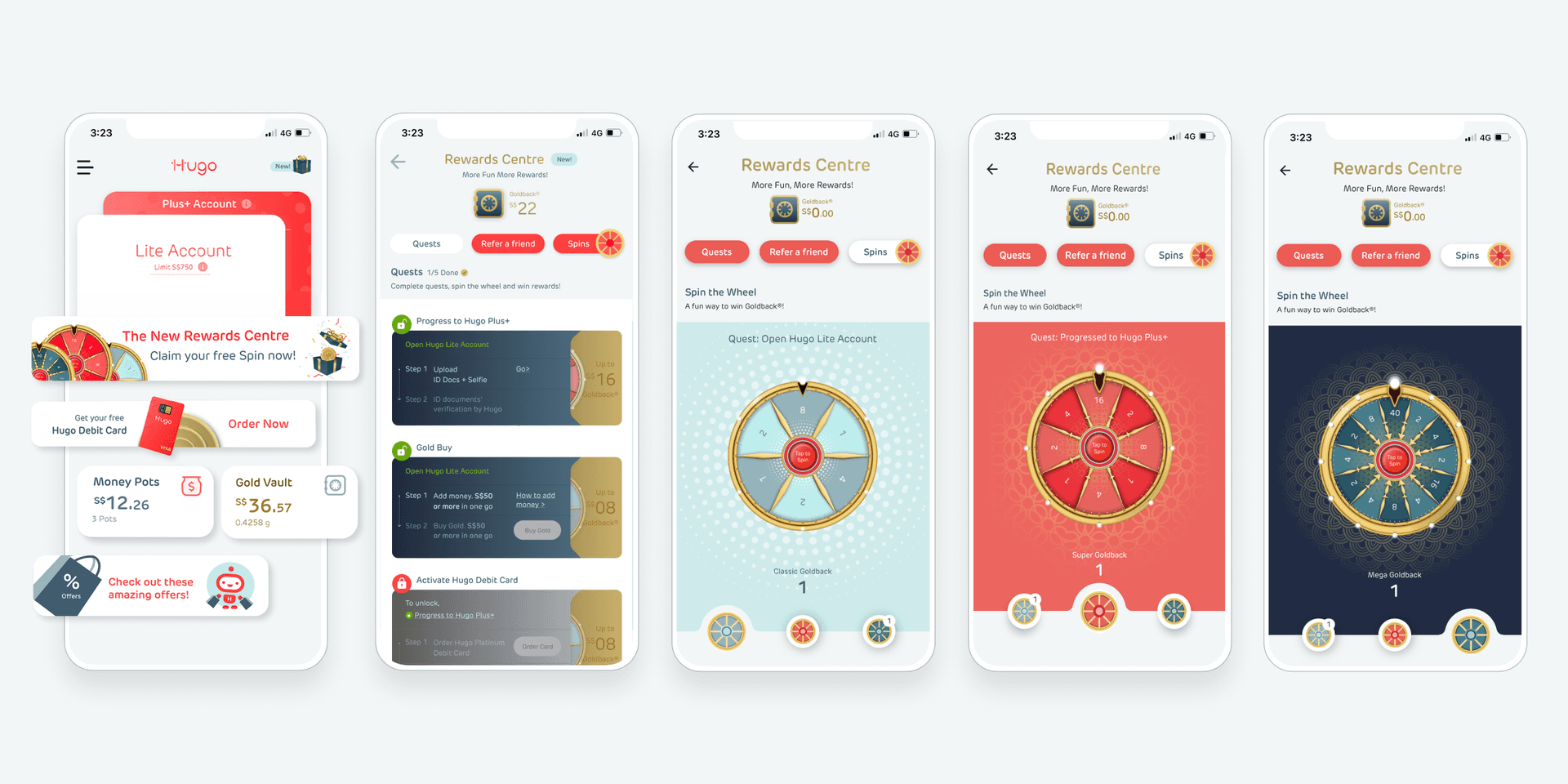

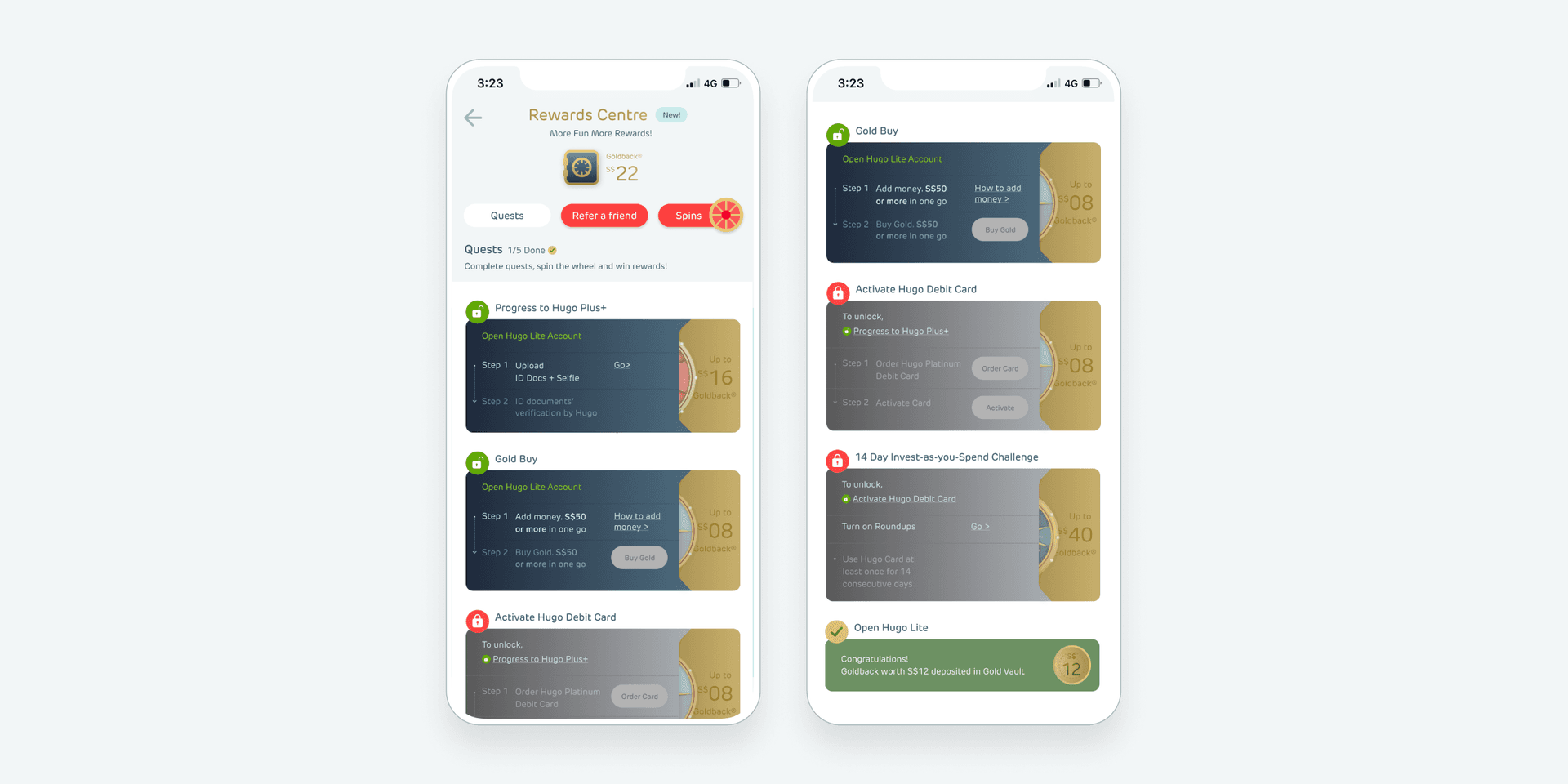

For their first campaign, they wanted to personalize the onboarding process and gamify clients’ efforts to learn about saving and investing, with the primary goal being to ramp up client acquisition.

Building Brand Loyalty with Strategic Touchpoints

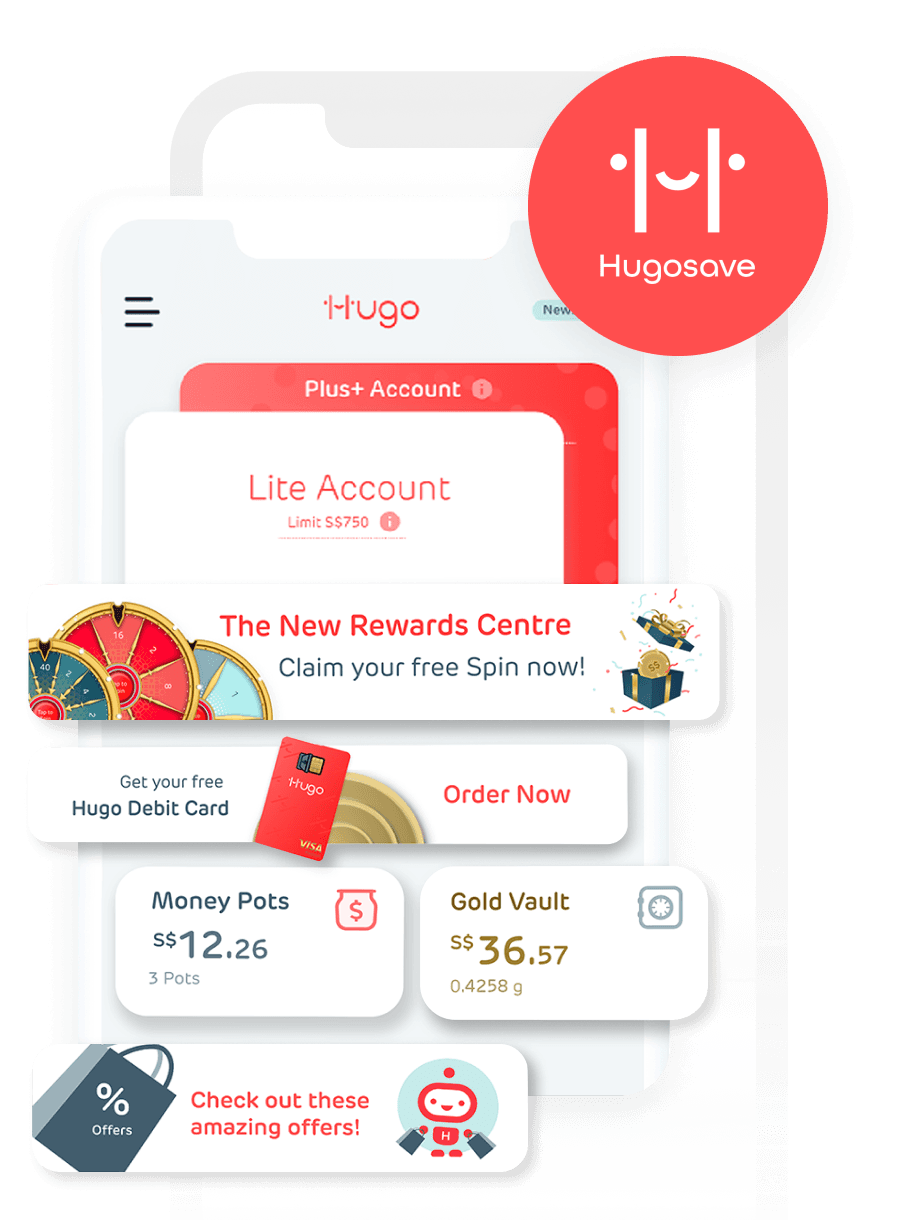

Hugosave serves as a friendly digital companion who nudges clients towards desirable financial behaviors. Accordingly, the company needed a tool that would allow them to be present throughout the client journey. Having created their “Lite” version of Hugosave as a way to introduce clients to their platform as seamlessly as possible while adhering to regulations, the next step was to figure out how to drive conversions to “Plus+.” After identifying that there was some existing friction in the onboarding process, the team got to work optimizing it.

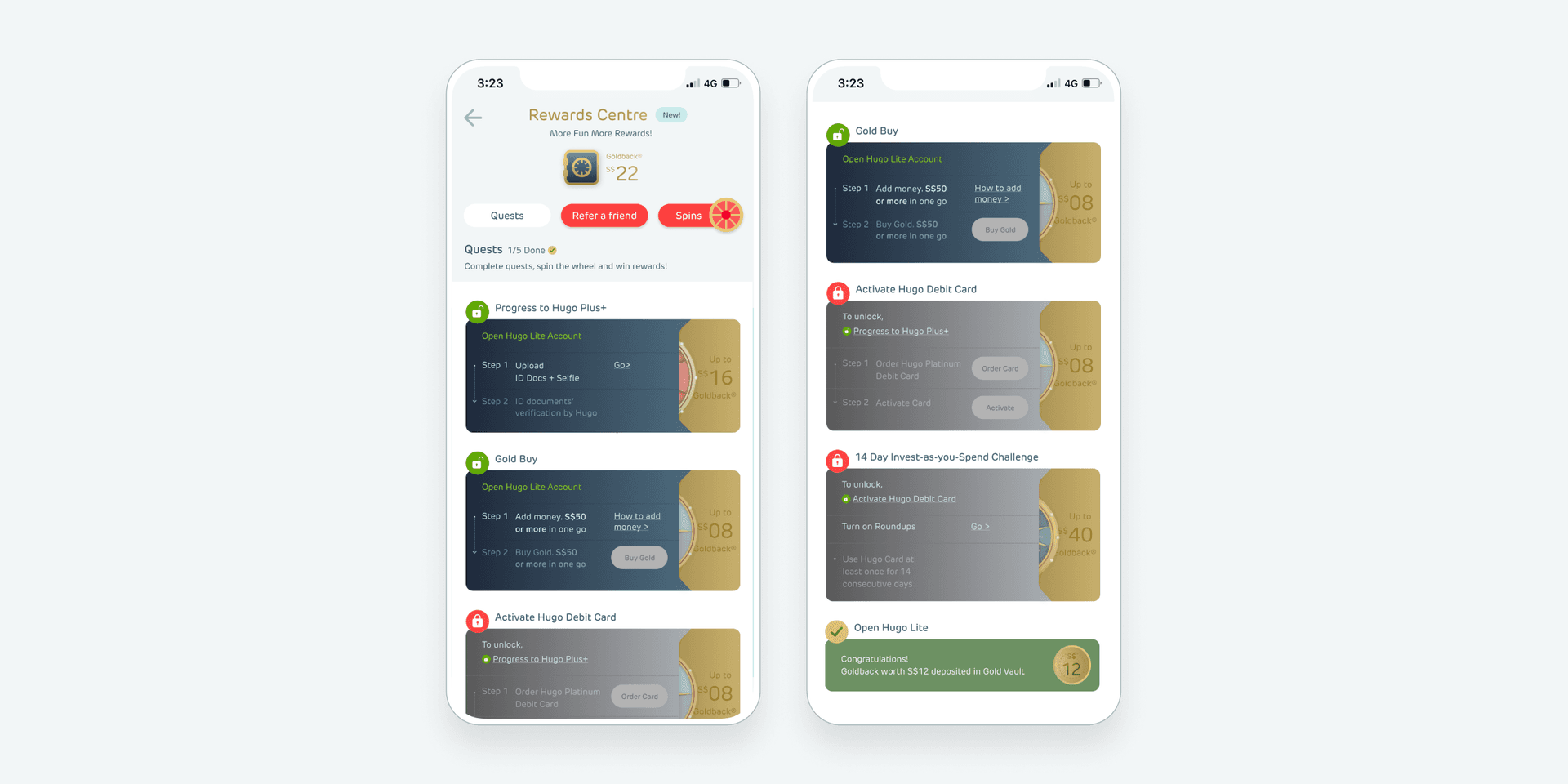

The hypothesis that drove Hugosave’s campaign’s development was simple: Reinforcement learning is an effective mechanism to drive client behavior. The overall objective was to guide their clients—dubbed “HugoHeroes”—through the various stages of signing up, onboarding, and referrals by setting up campaigns with multiple strategic touchpoints to form a cohesive, relevant, and personal experience for every client. Hugosave theorized that by designing a more robust onboarding experience, customers would not only become long-term clients, but would also rave about the quality of the platform to others.

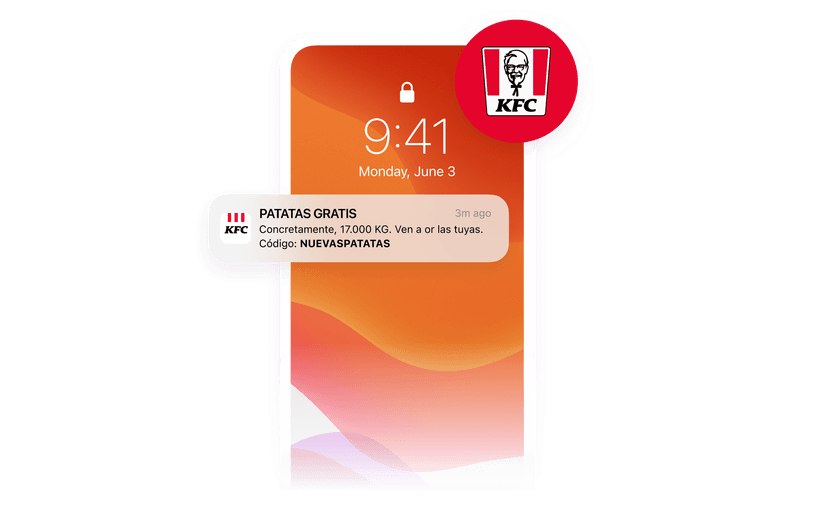

To start, Hugosave began building out a comprehensive journey with Canvas Flow, our no-code customer journey builder. The onboarding flow follows HugoHeroes through “Quests,” a gamified way to showcase to clients what the platform has to offer, showing off primary product offerings and value-adds like forums and social media. Delivered across different in-product channels like Content Cards and out-of-product channels like push notifications and email, Quests include watching tutorials, reading blog articles related to saving, learning about Plus+ features, and following Hugosave on social media. Clients were then rewarded for completing Quests through exciting wheel spins that award up to S$80 in GoldbackⓇ collectively.

Since launching the campaign at the end of 2021, Hugosave has made significant strides, as evidenced by their onboarding rate from download to sign-up, the speed of conversion, and customer feedback. Down the road, they’re eager to continue using Braze as a tool to further build out their gamification and engagement strategies.

Braze is a very important partner in the execution of our engagement and gamification strategies.

Braham Djidjelli

Co-Founder, CPO at Hugosave

Hugosave Results: Robust Onboarding and Acquisition Gains

By leveraging Canvas Flow to create a cross-channel onboarding journey, Hugosave was able to create tailored and engaging client journeys. Hugosave clients receive close guidance as they learn how to use the app, receive encouraging nudges to build good financial habits and enjoy the benefits of WealthcareⓇ.

Key Takeaways

- It’s no secret that friction during onboarding can lead to drop-off. Simplify the process as much as possible while simultaneously demonstrating value to maximize conversion.

- Building relationships as a brand is kind of like building relationships with people—if you’re out of sight, you’ll likely be out of mind. Meaningfully engage users from the start to build a solid foundation for long-term loyalty.

- It’s your job to educate users about the value of your product. Lead them in the right direction, and consider rewarding them for the actions they take to engage.