The State of Customer Engagement for Retail and eCommerce Brands

Published on May 25, 2022/Last edited on May 25, 2022/5 min read

Mary Kearl

WriterAs early adopters of digital and mobile marketing strategies, retail and eCommerce brands have been positioned for success during the current wave of digital acceleration and transformation brought on by the pandemic. At the same time, however, the industry has been up against major supply chain challenges (also brought on by the pandemic) that have made effective customer engagement a key competitive advantage.

With customer engagement best practices continuously evolving in line with shifts in customer behavior and technology, each year we conduct the Braze Global Customer Engagement Review (CER) to reveal the latest customer engagement activities that set leading companies apart from the rest. Here's what we learned about the state of customer engagement for retail and eCommerce brands as part of our 2022 CER and here's what your team can do to deliver gains across customer activation, monetization, and retention.

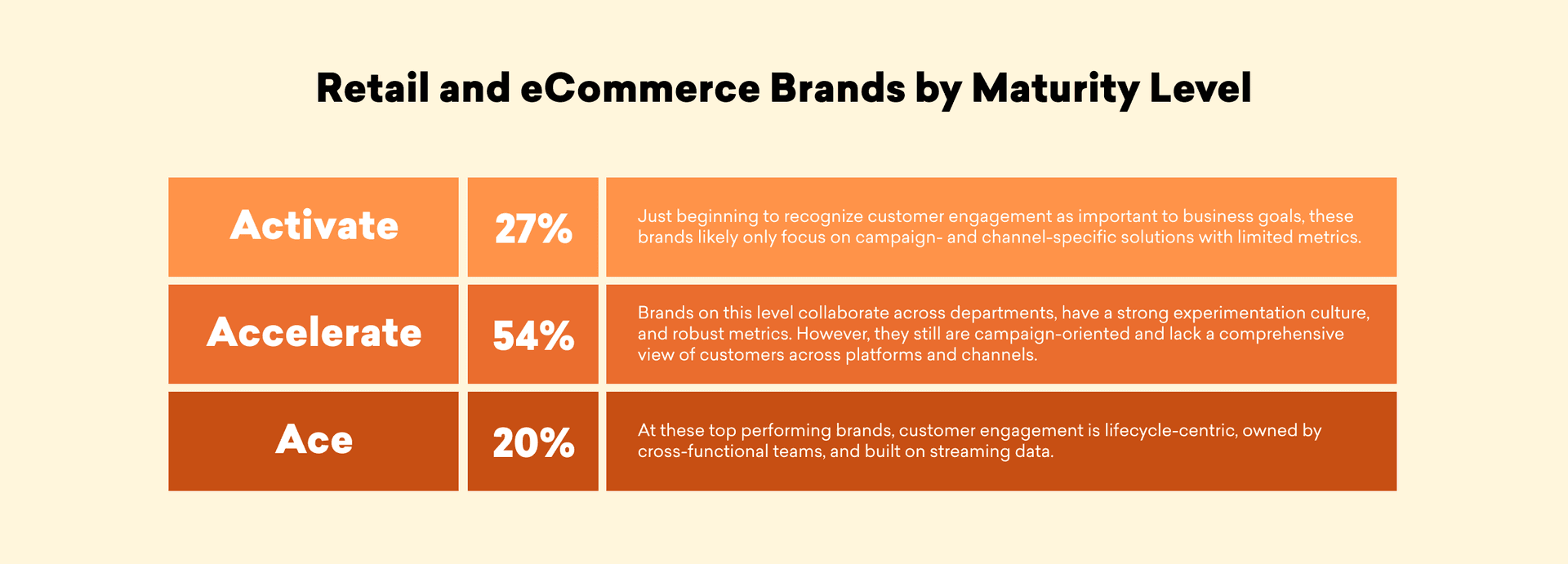

How Retail and eCommerce Brands Rank on the Braze Customer Engagement Index

In 2021, we introduced The Braze Customer Engagement Index to offer a clear framework for evaluating customer engagement performance at the company level, industry level, and geographical level—by region of the world.

This year we used the Braze Customer Index to find out how retailers and eCommerce companies are doing. Here's what we discovered.

Retail and eCommerce outpaced all of the other sectors we studied, including QSR and delivery, FinServ, health and wellness, and media and entertainment organizations. QSR and delivery brands come in a close second when it comes to customer engagement maturity, but have a smaller share of organizations achieving the top level of maturity in this area, with 18% unlocking Ace status, compared to 20% of retail and eCommerce companies.

In addition, a research survey we commissioned of 1,500 marketing executives found that 76% of retail and eCommerce brands have been using mobile as a channel for customer engagement for 6+ years. Accordingly, it follows that the majority of retail and eCommerce sales—73%— now take place online, representing 51% of industry revenue.

What Sets Retail and eCommerce Customer Engagement Leaders Apart

To see what sets Ace retail and eCommerce brands apart from the rest when it comes to customer engagement, we took a look at their top differentiators. Here's what we found they have in common and how that's helping them yield customer engagement gains.

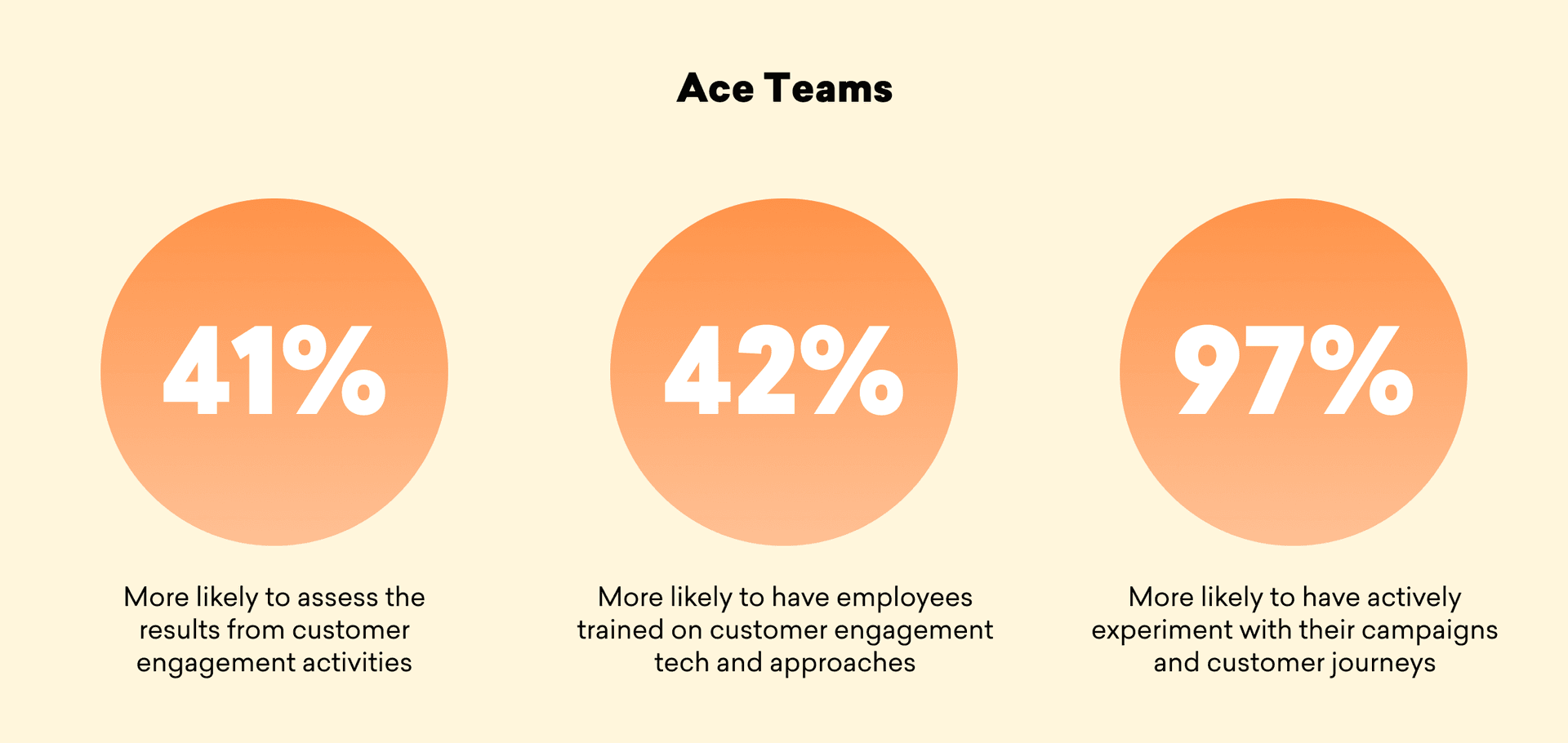

#1: Teamwork

Compared with retail and eCommerce brands that are just getting started on their customer engagement efforts, leaders within the industry are more likely to:

- Measure the impact of their customer engagement efforts

- Provide training for their customer engagement team members on customer engagement technologies and best practices

- Conduct marketing campaign testing and test their customer journeys

This focus on preparing their teams on how to make the most of their customer engagement efforts and testing, assessing, and optimizing their marketing programs helps Ace retail and eCommerce brands set their strategies up for success and provide better experiences for their customers.

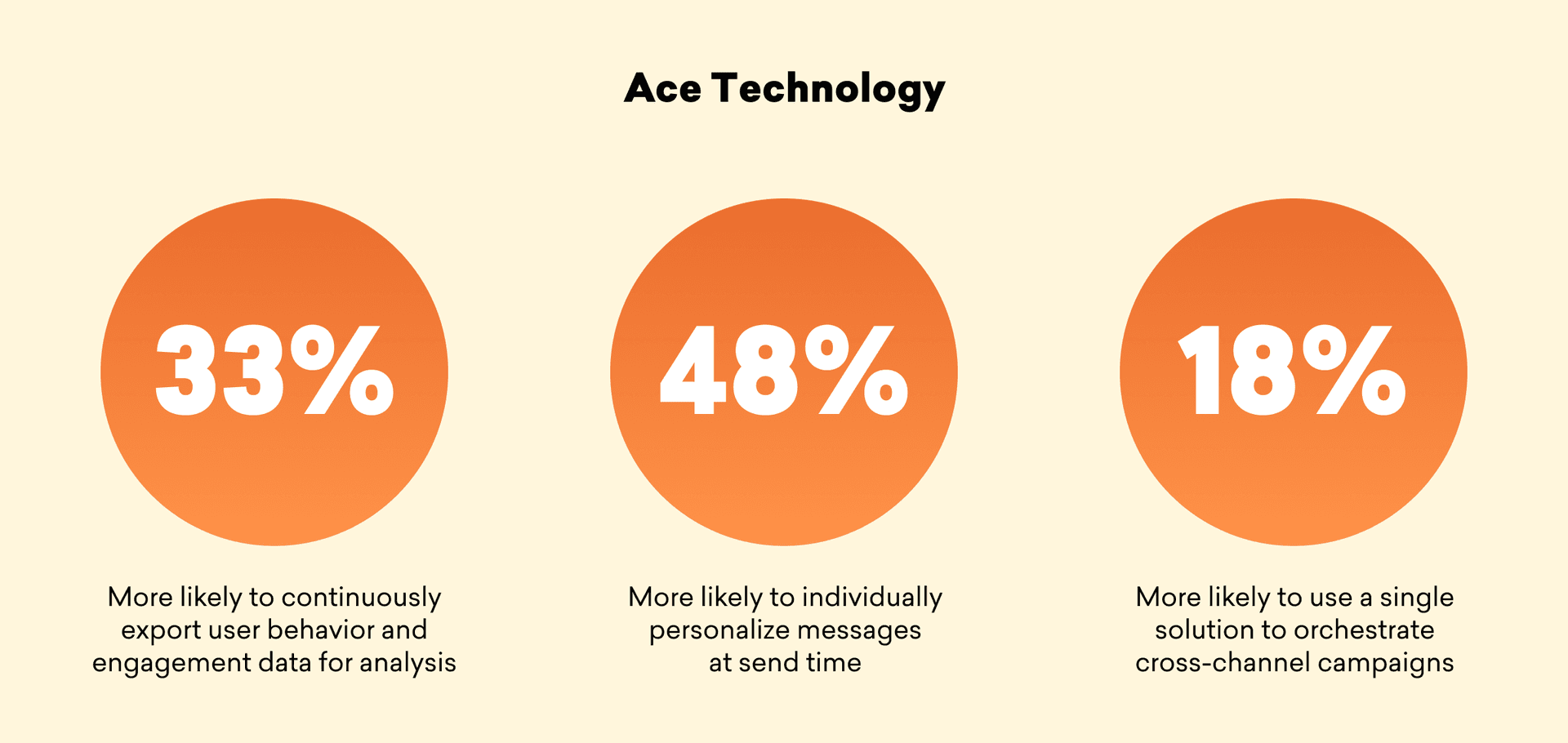

Customer engagement leaders within the retail and eCommerce sector stand out for being more likely to:

- Take advantage of the real-time customer behavior and engagement data for analysis

- Personalize marketing messages right at the moment of sending the campaign

- Use one single platform to orchestrate cross-channel campaigns

By centering automated, personalized, cross-channel messaging campaigns, Ace retail and eCommerce brands can provide customers with more timely and relevant experiences on the channels that they prefer, supporting strong marketing results over time.

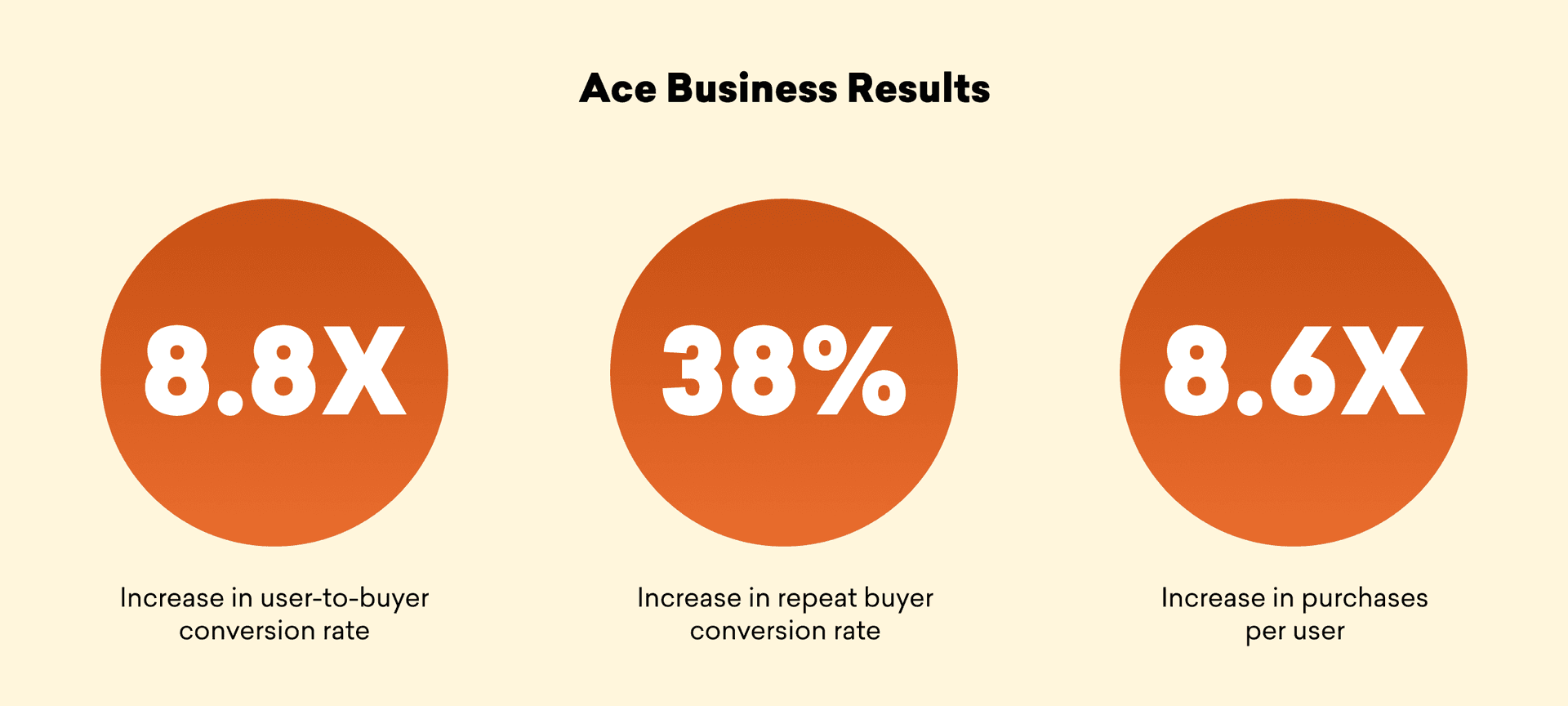

#3: Results

Ace retailers and eCommerce companies significantly outperform the rest when it comes to a number of KPIs that matter for brands in this space. In particular, they see user-to-buyer conversion rates that are nearly 9X higher, repeat buyer conversion rates that are almost 40% higher, and purchases per user that are 8.6X higher.

Top Customer Engagement Opportunities for Retail and eCommerce Brands

Here are the top two areas where retail and eCommerce brands have a clear opportunity to enhance their customer engagement efforts and get ahead of the competition.

#1: Embracing teamwork to address strategic challenges

By prioritizing customer engagement experimentation, strategy, and staffing, retail and eCommerce brands have the opportunity to:

- Expand their brand reach

- Strengthen their customer relationships

- Address challenges related to the coming end of third-party cookies

- Improve customer retention

#2: Improving zero- and first-party data collection and management to enhance targeting and enrich customer engagement campaigns

More than one-third of retailers and eCommerce brands plan to increase their budgets to focus on zero- and first-party data, according to our market research survey. By investing in technical capabilities, brands will be able to operationalize this data in relation to campaign orchestration and messaging channels, resulting in more personalized, relevant experiences for customers.

About the 2022 Braze Global Customer Engagement Review

The findings presented here and included in the full 2022 CER are based on an analysis of the following three data sources:

- A market research study of 1,500 marketing executives at the VP level or higher from across 14 global markets, representing B2C companies with $10 million or more in annual revenue

- An analysis of data from over 5.4 billion global users from the Braze customer engagement platform, which powers experiences between consumers and 1,000+ brands across 50+ countries

- 1-1 interviews with top brands to get in-depth insights about their customer engagement efforts

Even More Customer Engagement Strategies for Retail and eCommerce Brands

Want to better activate, monetize, and retain your retail or eCommerce customers? Head to the full 2022 Global Customer Engagement Review for even more insights on the state of customer engagement for retail and eCommerce brands and beyond. Plus, find out how Mercari has boosted sales by nearly 9% and return on ad spend (ROAS) by more than 180% by encouraging incremental gains in customer activity.

Related Tags

Be Absolutely Engaging.™

Sign up for regular updates from Braze.

Related Content

View the Blog

How behavioral marketing turns data into personalized experiences

Team Braze

2025 Braze year in review: Major moments, milestones, and evolutions

Team Braze

AI customer segmentation: Smarter targeting through predictive insights