Published on October 05, 2017/Last edited on October 05, 2017/6 min read

Since the introduction of the first iPhone a decade ago, the rise of mobile has been disrupting industries and upending the business models and customer engagement strategies of entrenched brands. But the impact hasn’t been uniform across verticals—and highly regulated, slow-moving industries like banking and finance have been some of the least affected to date.

That’s starting to change. Thanks to ongoing innovations in the technology space, the way that people pay bills, earn money, and squirrel away savings has begun to evolve in a major way. New peer-to-peer (p2p) money transfer companies and banking and investment apps like Venmo, Digit, Robinhood, Acorns, and Stash Invest are shaking up the traditional world of investing, finance, and business with these mobile, email, and digital marketing strategies designed to serve customers across channels with personalized solutions that meet their ever-changing needs.

Let’s take a look at what they’re doing and the tools and tactics they’re using to make it happen:

IRL, the only fun thing about a check being written or cash being given is being on the receiving end. Online, apps like Venmo are stealing a play from word-of-mouth marketing, working to increase their app users by turning the act of making payments into a social activity. While the offline scenario of getting and depositing a check is usually a solo act with no audience, the digital equivalent has the potential to have an extensive, socially engaged audience.

Through multichannel activity messaging, powered via its app, website, and emails, Venmo takes every opportunity to gamify making payments. First, through the simple act of providing an alternative, mobile-friendly way to pay people, and second, by encouraging users to broadcast on social media which friends they’re paying—and for what reason. And coming up with clever reasons is where the fun begins.

This approach is powerful—but Venmo could take things a step further by rewarding activity such as social shares, inviting friends, repeat usage within the app, or maintaining a minimum balance.

Credit: Digit

We’ve said that the future of marketing is immersive, automated, and platformed. And while financial companies—often thought of as behemoth, slow-moving brick-and-mortar institutions—might not be top of mind as innovators in this space, look no further than personal savings tool Digit for mobile-marketing envy and inspiration. For anyone who ever wanted a virtual assistant just for managing your budget, Digit is the app for you. To power its automated, personalized savings on behalf of customers, Digit offers cross-channel bots, operating via SMS and in-app messaging, to figure out what individuals need to spend and what they want to save.

While we’ve bemoaned virtual assistants and bots for not getting personalization quite right, Digit offers personalization in a variety of flavors, leveraging artificial intelligence to learn each user’s financial preferences for savings and spending—and on the communication side of things, a user’s favorite emoji to power its emoji marketing efforts.

Digit takes things a step further by gamifying social sharing of the app. Friends who invite friends to save can earn up to $25, creating a powerful incentive for loyalty users to serve as brand evangelist.

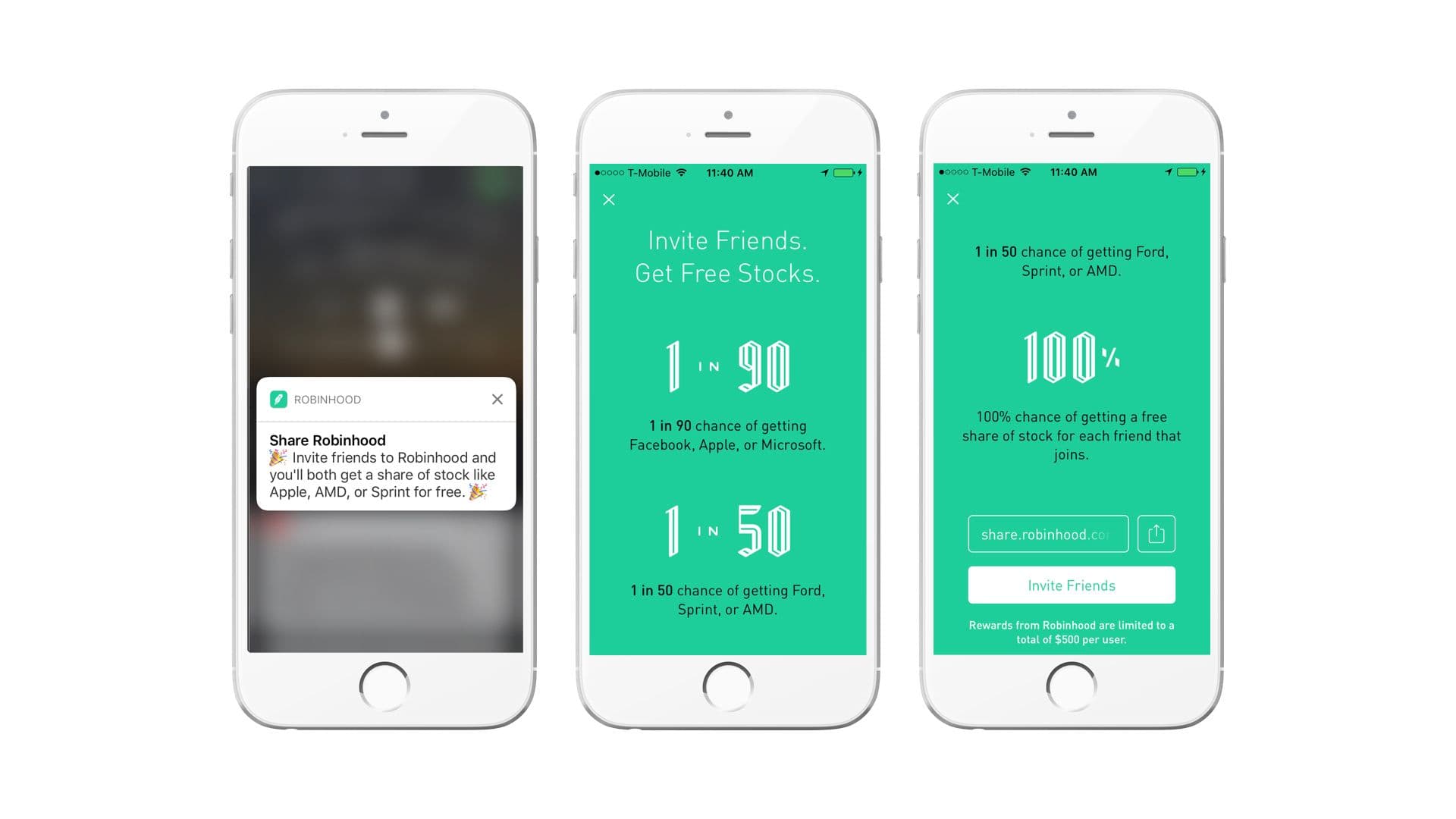

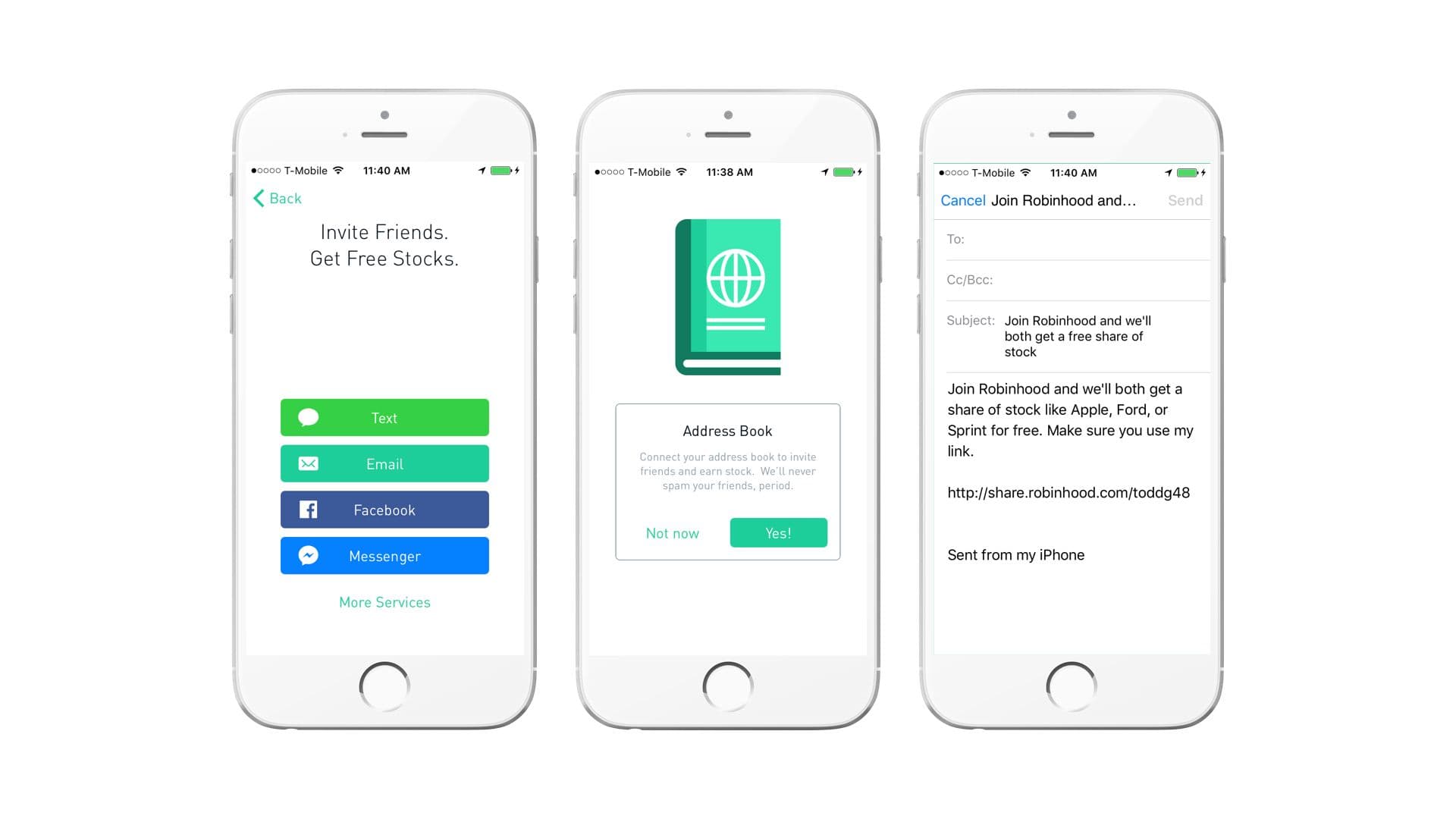

Credit: Robinhood

Mobile investment app Robinhood, like its name suggests, is all about sharing the wealth. As the brand informs users in its clever onboarding and next-level multichannel marketing refer-a-friend campaign, friends who invest together, get free stocks together. Customers are notified about the reward for referrals via push notifications and in-app messaging and can invite others to join in via social media and email.

Around 80% of millennials don’t currently invest in the stock market. The top two reasons? They don’t have enough money to do so, and don’t know how, according to a 2016 poll. The Acorns investment app tackles both of these barriers to entry with its multichannel onboarding campaign, which uses:

In-app messaging

When an onboarding campaign is cross-channel, it engages early-stage users wherever they are. Compared to single-channel onboarding messaging, which can help improve customer retention by as much as 71%, cross-channel campaigns are nearly twice as effective—having been shown to increase customer retention by 130%.

News Feed cards

As with in-app messages, News Feed Cards are seen by users when they’re in your app. One difference: You control how long they are visible for (they cannot be dismissed by users), so you can keep getting-started content and FAQs for the first few sessions and replace these with content for intermediate level users as they progress.

An email welcome message

More than any subsequent email, welcome emails have the highest open rates, almost 60%—nearly triple the average open rate. In keeping with best practices, Acorns welcomes customers in real time and include a special offer to earn $5 for every friend referred.

With many apps facing the same challenge: spending to acquire thousands of users, but retaining hundreds (or fewer), convincing customers to make the jump from a free trial to a paid subscription app is an even greater challenge, with greater rewards.

Building your business off a subscription-based model can significantly boost average revenue per user (ARPU) since customers are billed on an ongoing basis, providing revenue beyond advertising or one-time in-app charges. The revenue upside may sound great, but making it happen means effectively selling free-trial users on why they should subscribe from the start, then delivering on that value over the life of the subscription.

As with Acorns, Stash Invest is in the business of helping people overcome investing hurdles, such as limited funds or awareness. To help with the onboarding process for what can be an intimidating activity, Stash Invest celebrates the small milestones along the way with in-app messaging and taps into personalization to make the process of deciding how to invest less daunting, limiting the chances that customers fall victim to decision paralysis.

Sign up for regular updates from Braze.