4 min read

Simplii Financial Increases Conversions and Reduces Time-to-Market With Braze

Simplii Financial wanted to help manage client expectations through better personalization with user journeys that inform customers about offers available to them.

With Braze, they quickly launched a personalized direct-to-user campaign that showcases only relevant offers that clients were eligible for.

The campaign resulted in a significant rise in conversions and reduction in time-to-market.

INDUSTRY

PRODUCTS USED

BY THE METRICS

2

weeks or less for campaign creation

Simplii Financial is committed to delivering unbeatable value, offering straightforward products and services, and remaining available to customers around the clock to provide a loyalty-worthy banking experience.

Motivated by the belief that customer engagement enhances the user journey and allows them to efficiently and effectively inform clients of offers that they’ll want or need (and if they’re lucky, could land them in primo seats at the biggest sporting event of the year), Simplii Financial actively keeps in touch with their customer base to achieve organizational goals:

- Optimize and innovate to achieve best-in-class results.

- Leverage robust digital journeys to maximize sales conversions.

- Maximize the effectiveness of data-driven insights, prioritization, and operational efficiency.

Simplii Financial adopted Braze in 2018 to better create strategic messaging and upgrade the customer experience, all while saving time and money.

How Simplii Financial Maximizes the Effectiveness of their Customer Engagement Strategy to Achieve Better Results

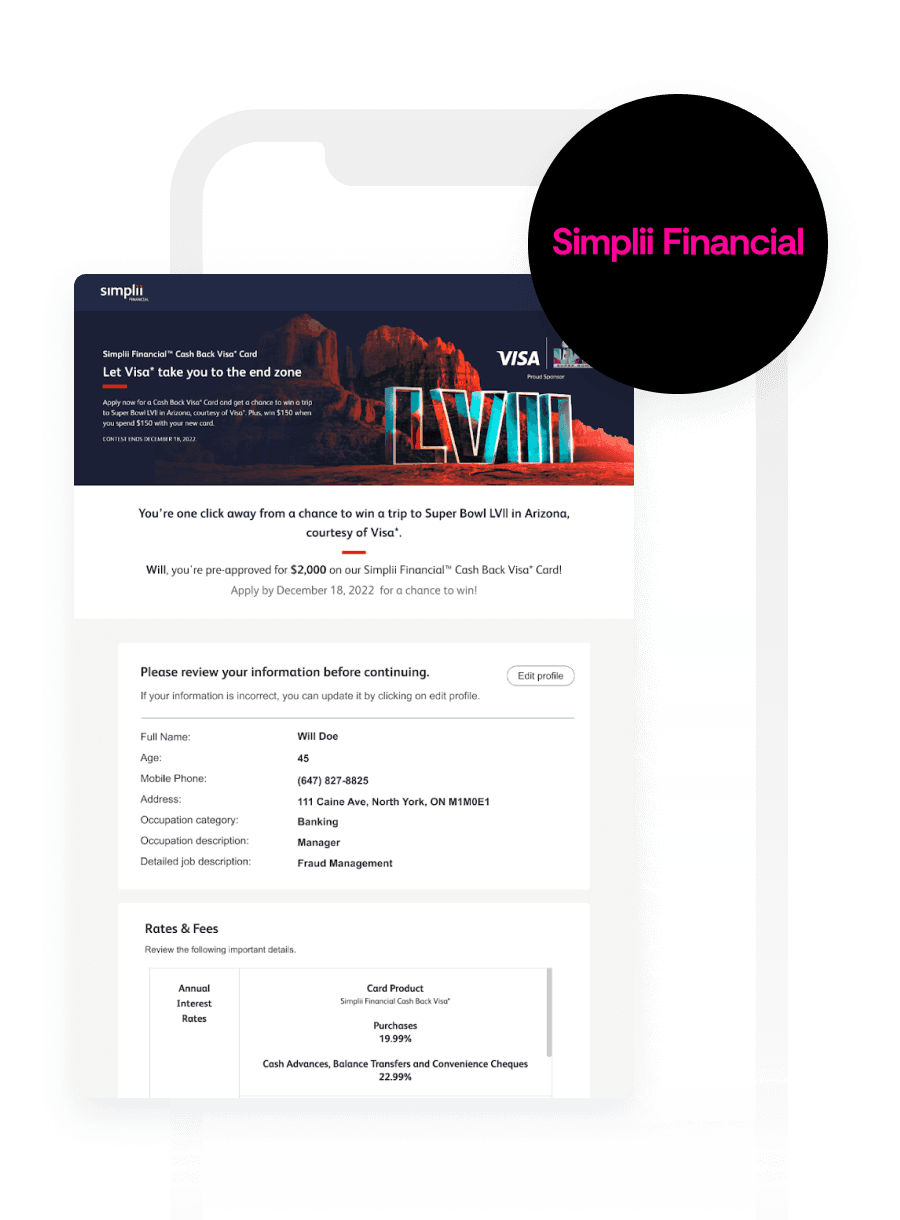

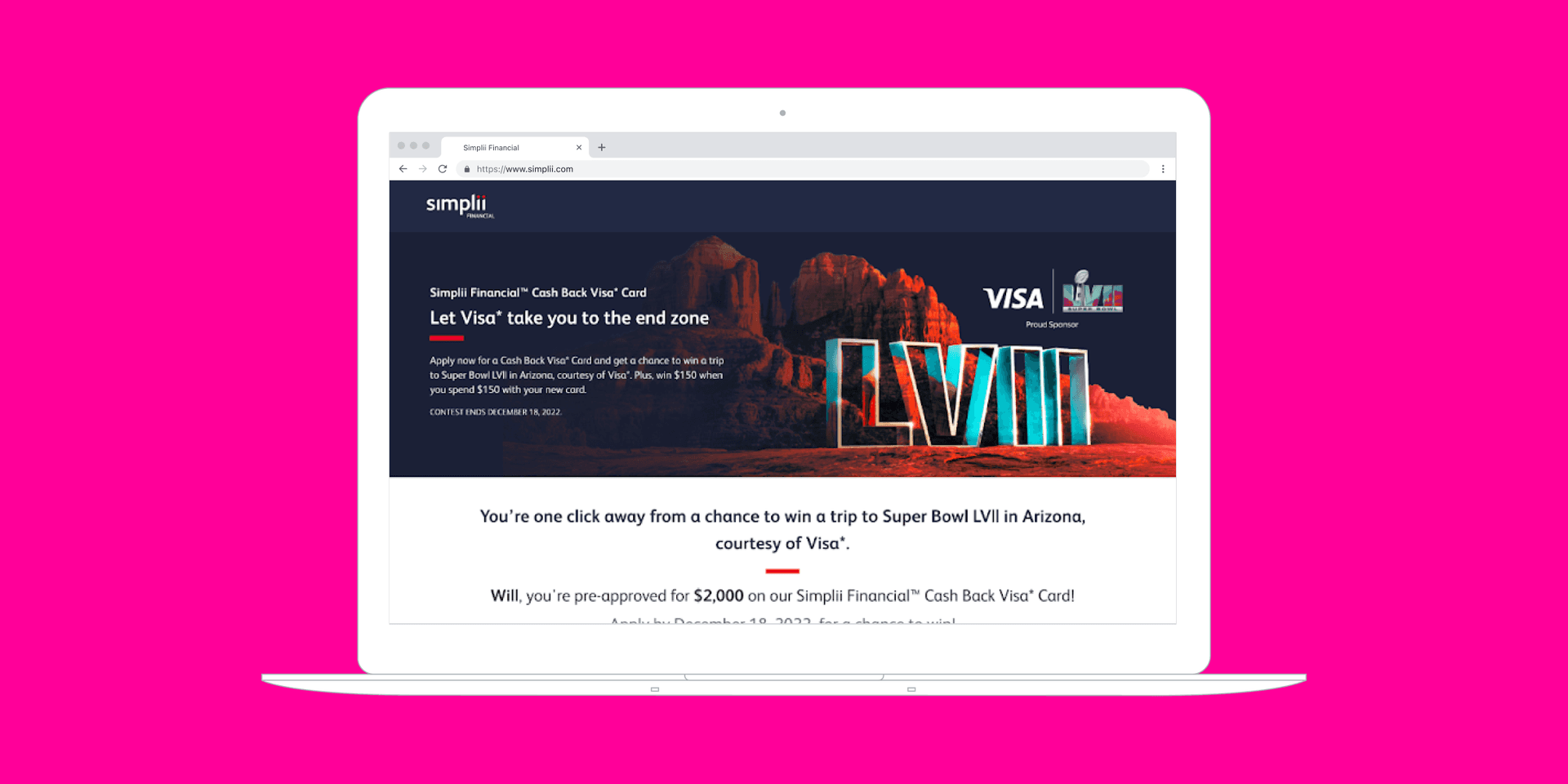

Simplii Financial originally selected Braze as its customer engagement platform to build out push notifications alone, but Simplii Financial—its direct bank and digital banking division—has expanded its channels and use cases over the past year. With the goal of minimizing customer pain points around eligibility and acceptance (and thus increasing conversions), they launched the “Simplii Super Bowl One Click Credit” campaign.

This campaign served up personalized, pre-approved credit card offers that users could apply in just one click. Clients who applied were also entered to win a trip to the Super Bowl LVII in Arizona, and would receive a $150 bonus incentive awarded to the new cardholder upon spending $150. Paired with sharp copy that communicated the various components of the value of the offer, the sleek messages made it possible to accept the credit card offer with, quite literally, the click of a button.

To execute their credit card offer campaign, they used the following:

- In-app messaging

- Webhooks, which facilitate communication from one application or service to another that takes place following a pre-selected event

- Connected Content, a dynamic personalization tool that helps brands customize messages with personalized information from your company's own internal servers and third-party APIs.

- Liquid, an open-source, customer-facing template language that serves as a scalable tool to ensure that marketing content is personalized and informed by relevant context

- Currents, which enables brands to automatically move data between Braze and other layers of their tech stack. Currents help brands derive key insights from both customer behavior events (how customers are engaging with a brand’s digital platforms) and message engagement events (how customers are engaging with the messages they receive)

The problem they were hoping to solve with this campaign began with switching their Digital Distribution Channel (DDC) campaigns from an internal system to Braze. This enabled the team to decrease message development time while increasing their ability to hyper-personalize messaging.

Eligible customers for the campaign received customized offers through in-app messaging and email, prompting them to accept a pre-approved credit card offer. Simplii Financial utilized Connected Content and Liquid to pull relevant customer information, like their name, into the messages, cutting out a step in the application process by auto-populating details customers would otherwise have to enter manually. They further customized the message with HTML.

The campaign took about 5+ weeks to execute in Braze, however moving forward they estimate they’ll be able to use what they’ve built to reduce the marketing execution process to 2 weeks or less.

Simplii has made a foundational investment into our marketing technology stack to enable data at scale, and to drive product and client growth across several different platforms. Deepening our relationship with Braze has helped us ensure this vision at scale and making certain our clients are receiving the right communications at the right time.

Joe Orsini

Director of Digital Expansion, Optimization & Personalization, Simplii Financial

Simplii Financial Results: More Conversions and Strides Toward Optimal Marketing Efficiency

Through the development and use of hyper-customized messages, Simplii Financial successfully executed their credit card offer campaign, resulting in a significant increase in conversions and massive efficiency boosts that will pay dividends in campaign development to come.

Key Takeaways

- Invest in making it as easy and efficient as possible for your customers to buy what you’re selling. By strategically minimizing the hoops your customers have to jump through to get to what they want or need from you, you’ll likely see conversions tick upward.

- Do the work upfront to increase the efficiency of your marketing processes. Done well, the time investment pays for itself repeatedly when you build a strong foundation that you can use as a launch pad to streamline campaign development down the line.